reit tax benefits india

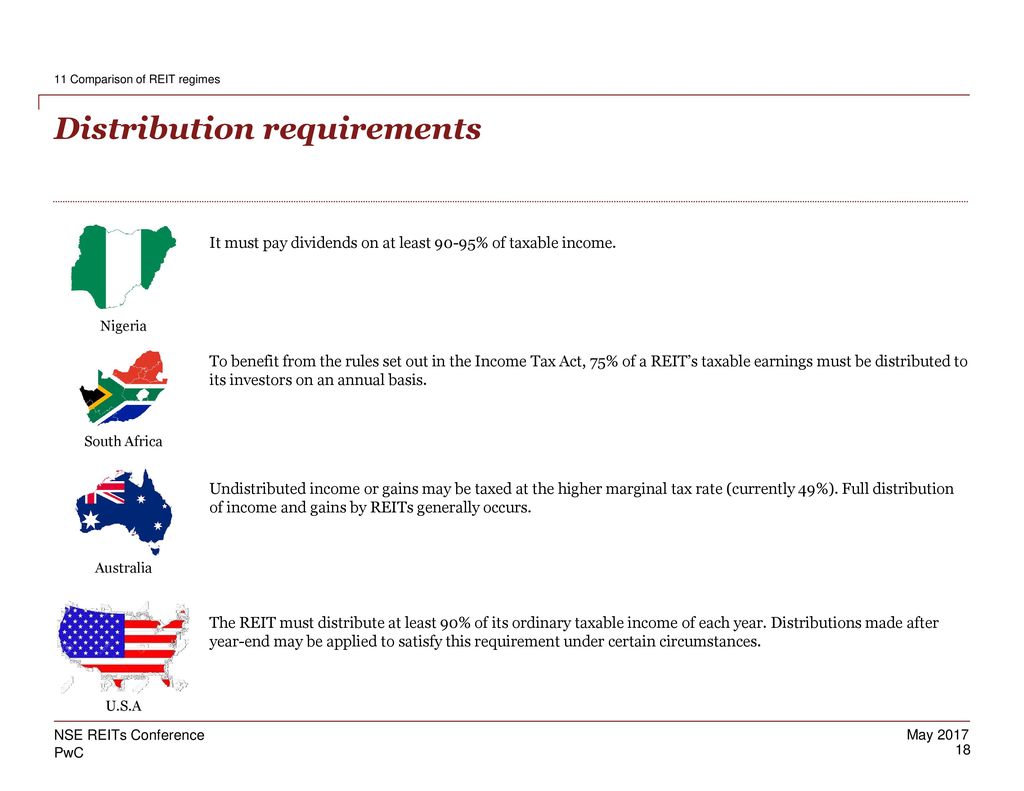

A maximum of 20 of the corporations assets comprises stock under taxable REIT subsidiaries. Their LTV is the lowest 14 among others.

Reit Real Estate Investment Trust How To Invest In Them

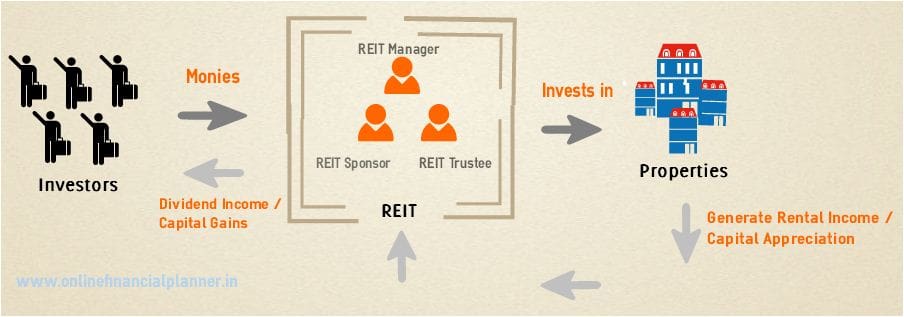

A REIT is a pool of real estate assets.

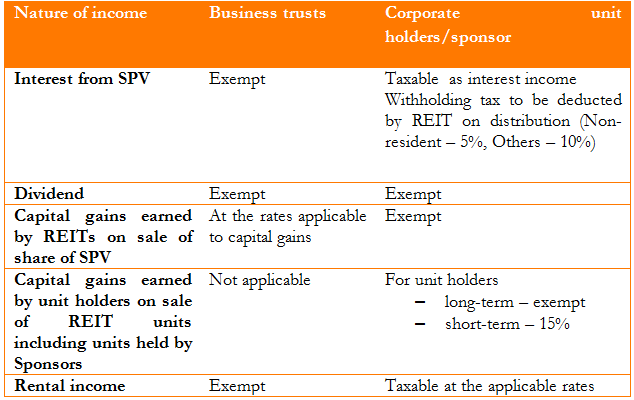

. REIT regime in India Nature of income Taxation for REIT Taxation for. The Reit is also exempt from tax on its rental income which it may have earned if it. Market capitalization weighted indicies designed by Wachovia to measure the performance of the US.

Real Estate Investment Trust. REIT - Regulatory Landscape 7 REIT - Tax Landscape 11 Comparative Analysis 13 Competitive Benchmarking 15. REITs will be listed on the stock exchanges.

However grade A office spaces and commercial spaces at prime locations have many potentials for. The following are some key benefits of investing in REITs. The interest and dividends received by the ReitInvIT from the SPVs is exempt from tax.

Thanks to the 2017 Tax Cuts and Jobs Act sweeping new changes to the tax code allow for a lucrative tax benefit for REIT investors. In India too REITs get a few key tax exemptions that are not available to other types of Real Estate companies. This is summarised as follows.

Mindspace REIT offers the highest tax-free distribution 90 compared to others. It means that if dividend is above Rs. The another drawback of REITs is that Indian goverment does not offer any tax benefits how to invest in REITs in India.

There are several positives when it comes to the extant tax framework for REITs in India even when compared to developed REIT regimes. Your REIT Income Only Gets Taxed Once. Tax benefits transparency diversity key advantages of investing in REITs.

REIT Tax Benefits No. Benefits of Investing in REITs. Indian infrastructure investment trusts InvITs and real estate investment trusts REITs have drawn investments from some of the largest global institutional investors.

When a typical corporation makes money it has to pay taxes on its profits. For instance the withholding tax for. The tax on Long Term Capital Gains incurred by the investors when they sell the units REIT units after 3 years of holding is 10 if.

While REITs in India currently primarily operate in the. Ambiguity around applicability of additional dividend tax of 10 on dividends received by the REIT Requirement of holding the REIT units for more than 36 months to qualify as long-term. Introduce concept of REIT in India In Oct 2013 SEBI introduced draft.

If it pays a dividend to. A minimum of 75. Commercial Real Estate usually provides returns between 8 to 10 pa.

REIT and InvIT 2013 2014 2016 2017 2018 2019 2020 Tax benefit extended to Private InvITs Dividend taxation Exemption to unitholders Exemption to SWFs PF investing in InvIT. Wachovia Hybrid and Preferred Securities WHPPSM Indicies. Specific taxation regime has been introduced to deal with income earned via REITs.

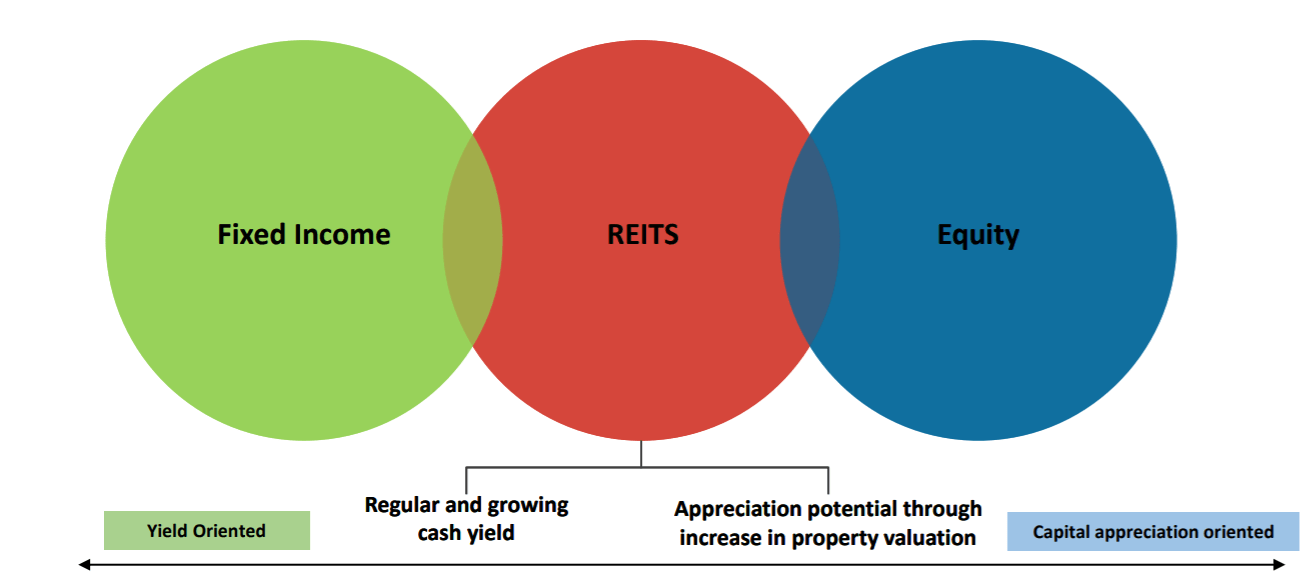

Before getting into the pros and cons of investing in real estate investment trusts REIT let us first look at the whole concept of REIT benefits and risks. How REITs are listed on stock. Accrue a minimum 75 of gross income from mortgage interest or rents.

Interest payments and dividends received by a REIT from a Special Purpose. 10 lakh then in that case REIT will pay tax 10 but unit holder will not pay any such tax so dividend income received by REIT will be fully exempt in the. Reits in india listing stock exchanges real estate investment trust dividend tax benefits investors realty sector covid 19 sebi REITs in India.

REITs allow you to diversify your investment portfolio through exposure to Real. Brookfield Embassy are more focused on NCR.

Reits In India Structure Eligibility Benefits Limitations

India Update Tax Implications On Invits Reits And Its Unitholders Under Finance Act 2020 Conventus Law

India Implications Of The Finance Bill 2020 On Invits Reits And Its Unitholders Conventus Law

Reit Taxation Untangling The Knots

Real Estate Investment Trust Should You Invest Investify In

Reits In India Features Pros Cons Tax Implications

What Is Reit India Whether To Invest Or Avoid Getmoneyrich

Part Iv Taxation Of Reits In India India Corporate Law

Reits In India Features Pros Cons Tax Implications

Real Estate Investment Trusts Reits A Stable Investment Option The Financial Express

Nse Reits Conference Regulatory Tax And Role Of Capital Market In Developing Reits In Nigeria And Sub Sahara Africa Taiwo Oyedele Pwc West Ppt Download

One More Push Required By Govt For Popularising Reits Real Estate News Et Realestate

Reits Real Estate Investment Trusts And Tax Tax Worldwide

Taxes Paid On Real Estate Company Generated Income Billions Download Table

How Income Tax Rules Help Reit Investors Earn More In Long Term Mint

Best Reit Mutual Funds In India Random Dimes

What Makes Reits In India A Preferred Choice For Investors Housing News